The “Peak Coal” Crisis

“World consumption of coal is growing at an outstanding pace, fueled by the increase in demand from China and India as their economies rapidly expand.”

By Pawan Shamdasani,

Since the 20th Century, coal has laid the groundwork for remarkable and ground-breaking developments; from new forms of production to new inventions and discoveries, transforming the economy that we live in today and making it one of the most important non-renewable energy sources.

Since the 20th Century, coal has laid the groundwork for remarkable and ground-breaking developments; from new forms of production to new inventions and discoveries, transforming the economy that we live in today and making it one of the most important non-renewable energy sources.

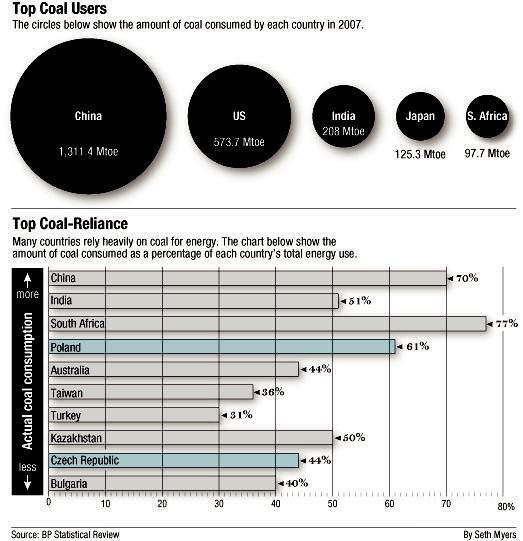

Coal accounts for more than a quarter of the world’s primary energy needs, provides 40 percent of the world’s electricity and powers two-thirds of steel production worldwide. World consumption of coal is growing at an outstanding pace, fuelled by the increase in demand from China and India as their economies rapidly expand.

Coal gasification and coal-to-liquids plants are being built at alarming rates as a result of a rise in the use of lower-quality fuels, that is, a gaseous or liquid fuel converted from coal. This surge in coal demand will lead to devastating consequences in a decade or two as we approach “Peak Coal” on a global level, driving up coal prices and affecting living standards for billions.

“Peak Coal” refers to a period when the global coal production rate reaches its maximum, after which, the rate of production undergoes permanent decline.

This theory has recently been supported by prominent research studies. In particular, two European studies, that were conducted in 2007, suggest world supplies of coal are in the decline.

The first study, “Coal: Resources and Future Production,” released by the Energy Watch Group (EWG) in Germany, concluded that coal production globally could peak in 15 years. This was based on a thorough analysis of reserve revisions for several nations.

Since 1986, these nations have experienced significant downgrades in coal resources after updating their reserves estimates. The downward revisions are best explained by better data collection from more thorough surveys and not by the amount of coal produced. Altogether, global coal reserves have seen a 60% drop in 25 years.

The second study, “The Future of Coal,” prepared by the Institute for Energy (IFE) supports the conclusions reached by the first study and expands on them. Specifically, the three additional conclusions this study presented were:

(1) “world proven reserves (i.e. the reserves that are economically recoverable at current economic and operating conditions) of coal are decreasing fast;”

(2) “the bulk of coal production and exports is getting concentrated within a few countries and market players, which creates the risk of market imperfections;” and

(3) “coal production costs are steadily rising all over the world, due to the need to develop new fields, increasingly difficult geological conditions and additional infrastructure costs associated with the exploitation of new fields.”

Should we worry?

The answer is yes, as peak coal translates to higher coal prices in the future.

How?

Well, for one, increased consumption and dwindling supplies of high grade coal will add pressure to world coal prices. Also, in most countries, coal recovery will incur higher production costs, leading to an increase in the global price of coal—since international coal prices are still related to production costs.

This rise in the price of coal will also reduce the relative gap between coal and oil and natural gas prices. As a result, these three energy markets will become more inter-connected, possibly developing into a global market of hydrocarbons. In particular, financial investors should beware the impact high coal prices will have on global electricity rates and, thus, on all manufacturing and service-related business activity.

China and India are the two key players in the future of coal. India, for one, is the world’s third largest coal producer, but is now also seeking more coal for itself through increased imports.

Meanwhile, China is currently the world’s primary consumer of coal and has become a net coal importer as of 2007. It will have to continue importing more coal due to the lower energy content of its own coal resources, depleting Asian supplies in the coming years and radically upsetting the market. In fact, to power its frantic industrial growth and generate electricity, China builds a new coal-fired station almost every week. They plan to triple generating capacity by 2030.

What is the solution to minimize the effects of “Peak Coal?”

Coal-dependant countries, especially China, are advised to reduce their consumption of coal now on a pro-active basis (since declines in production are expected to occur regardless) to prevent shortages and price volatility in the future. A failure to act now will only mean greater economic hardships once the peak arrives.

ARB Team

Arbitrage Magazine

Business News with BITE

Liked this post? Why not buy the ARB team a beer? Just click an ad or donate below (thank you!)

Share the post "The “Peak Coal” Crisis"