How to be a Successful Forex Trader?

Have you heard about Forex? Do you think you have what it takes to be a trader? No? Well, I have good news; everyone can be a successful trader!

You just have to follow some basic rules and get informed about the market so you won’t make the mistakes that some beginners do. Also, you have to select the strategies and the trading styles that suit your personality. It doesn’t matter whether you are trading stocks, forex, precious metals, futures, or, live binary options, these tips can help you to build a successful career as a trader. This article helps you take the first steps, choose your broker, and describe all the important rules to keep in order to be successful.

Let’s begin with the basics of the forex market!

The basics

Forex stands for foreign exchange, basically the different currencies of the world. The center of the market is the US Dollar as the general reserve currency for most nations. Usually, currencies are measured regarding dollars, and some the most important currency pairs are the ones with the USD in them.

A currency pair is the ratio of two currencies, for example, the EUR/USD; the ratio of the Euro and the US Dollar. This currency pair, actually the most traded one of all pairs, now stands at around 1.07. That means one Euro buys 1.07 dollars.

EUR/USD chart: An Example of Opportunities in the Forex Market

Not long ago, in June 2014, this ratio was 1.4. That is a huge (25%) move in the world of currencies, and these are the kinds of moves that make Forex very attractive for traders. In this market, you can make multiple times the amount of the moves of currency pairs as I will explain to you later in detail.

Some terms you need to know

Pip, big figure

This is the basis of every move in the forex universe. It means the fifth digit of the ratio—for example, the 5 in the 1.0715. A hundred pips are called one big figure, and that term is also commonly used to describe larger changes in currency pairs.

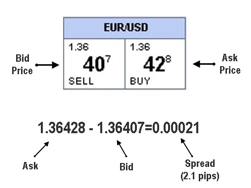

Bid, Ask, Spread

The difference between the two is called the spread—that is the ‘price’ you pay for your trade. The narrower the spread, the better it is for traders. When you choose a broker, as an active trader, this should be one of the first things to check.

Long and short positions

As a forex pair constitutes of two currencies betting on one of those means that it strengthens compared to the other one. Depending on which currency do you think will go you can be long or short a pair. Being long means that you bet on the ratio to rise and to be short means that you think it will fall.

Taking the EUR/USD as an example again, if you are long the pair you are betting on the Euro rising against the Dollar. Being short this pair is a bet on the Dollar against the Euro.

Investing or active trading

There is sometimes a huge distinction between investing and trading in financial markets. Investors usually hold positions for a long-term while traders focus on short-term profits.

This guide focuses on active trading, but that doesn’t mean you can’t hold the positions for long-term as an investment. On the contrary with proper risk management, a well-planned trading position can turn into an even better investment.

Share the post "How to be a Successful Forex Trader?"