The Evolution of Money

The dominate forms of money in the past, present and future

By Saif Qureshi, Online Co-Editor

Design by: Ryan Trinidad, Art Director

(First published in the Arbitrage Magazine Issue 4)

Money is one of the most important things in our lives. It helps ensure our survival and is a key to power. It is also one of the earliest and most significant inventions by humans and has become the foundation of our modern economies.

Hardly a day goes by without some discussion of money, its promises and its consequences. Almost everything around us has a cost attached to it and obtaining ownership requires money.

Yet, when it comes down to it, we are essentially paying for these goods or services through pieces of paper or through electronic signals (e.g. credit card or online banking).

In fact, we have become so accustomed to these forms of payment that many have never even paused to think about why and how they work. So in order to properly understand the current forms of money we take for granted, it is important to understand how our payment systems have evolved over time … and later, what they may evolve into.

THE DAYS OF WAY BACK WHEN

As surprising as it may seem, money didn’t exist among early human societies. In fact, barter was the first system of payment: an arrangement where two parties agree to exchange one good or service for another, thereby making a transaction.

It is not known exactly when this first started but it is quite possible that it dates back to the first humans. But although this system is very easy to understand and remained dominant for quite some time, there are few to no rules and the rate of exchange is vague.

But from 9000 to 6000 BC, with the advent of new farming techniques, a new form of barter grew in popularity. It became commonplace for farmers to trade commodities, such as cattle or grain, for some other good. This commodity money became an ideal currency because everyone knew what a bushel or cow was worth.

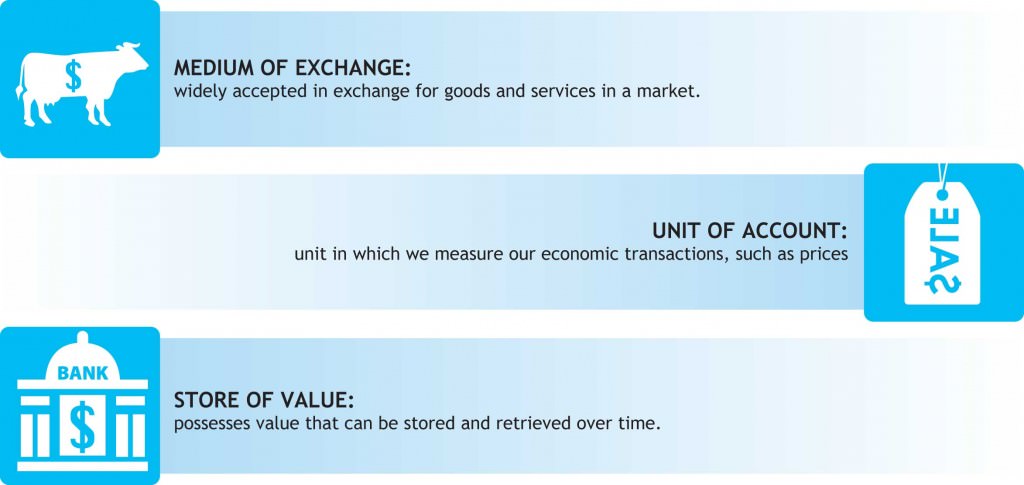

That said, in order for money to be a medium of exchange, it also needs to also be easily transportable and divisible, so that it can become easy to use. This is one reason why cattle are not used today as a form of currency; as it’s very inconvenient to hack a cow into small pieces, keep it refrigerated and bring enough of its carcass to a store to purchase a new shoe.

Considering the three functions shown in the infographic above, the first known primitive form of money was cowrie shells, which came into use around 1200 BC in China. These shells were found around the Maldives and were highly regarded in China and India, due to their attractiveness and rarity.

Similarly, much later on in history, American Indians highly valued wampum shells and used them for decoration, jewellery, religious ceremonies (buried in graves) and of course as money. In fact, these shells were acceptable for payments of debts, fines, tributes and even for ransom. All of these uses for the wampum shells and its symbolic value ensured that their demand and value remained strong.

Around 7th century BC, money evolved once again and started to become familiar to what we have today. In Turkey, bean-shaped currency was produced using gold and silver. These primitive coins had a special mark on them, which represented the coin’s specific value. Previous to this creation, the metal was simply exchanged based on its weight and purity, which made it very difficult to engage in a transaction since both of those qualities had to be measured.

Share the post "The Evolution of Money"